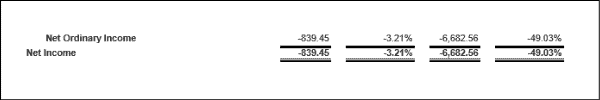

How to Read & Understand a Profit and Loss Income Statement

The Key to Unlocking Your Business Profits!

.

Understanding Your Profit and Loss Income Statement

Hey Badass Business Owner!

If you are like many small business owners, you have been hustling your butt off, creating all kinds of sales and yet your bank account doesn’t seem to be getting any bigger.

If only there was a tool to help you understand where your money is going and how to create more profit? Hmmm

Oh yea! You Do Have One!

Your Profit & Loss Income Statement has all the information you need to know!

What is a Profit & Loss Income Statement?

What is a Profit & Loss Income Statement?

In simple terms, a Profit & Loss Income Statement is the financial summary of your business. It tracks all the money that comes in, all the money that goes out, and what is left as profit and the end of the day.

By the time you get to the bottom of your profit and loss statement, you get to find out if you have a profitable month, or if you took a loss for the month.

It might be called a P&L, an Income Statement, or any combination of these terms. It can be done manually or printed from the report section of any bookkeeping tracking tool.

Why Do You Want to Know How to Read Your P&L?

What if I told you that all you need to know to double your profits can be found on this one piece of paper?

Would you want to learn how to read that piece of paper? Of course, you would!

Your P&L Income Statement has so much good, juicy information on it, that you will be shocked at what you will find.

- Want to know how much you did in sales last month? Last June? Last Year? Check!

- Want to know where your money is going & why so much disappears? Check!

- Want to know why your pricing might be wrong? Check!

- Want to know which categories you will get the best bang for your buck? Check!

- Want to know how your expenses are eating away your profits? Check!

- Want to know how to find quick profits dollars waiting for you to pick them up? Check!

- Want to know what percentage of sales you are putting in your pocket? Check!

- Plus many more questions can be answered if you know what to ask for!

Bottom line is, your profit & loss income statement can open up so many opportunities to find more money to keep in your pocket!

You just need to know how to find it!

It’s easier than you think!

It is Ok that You Feel Lost and Confused (You Are Not Alone!)

Now, I get that you might feel clueless when it comes to reading your profit and loss statement.

Heck, you may have never even looked at one before. That’s ok. You aren’t alone.

The sad fact is, about 75% if not higher of small business owners have little to no knowledge of how to read and use their profits and loss to grow their profit and sales. So, you are in good company.

But that is ok. You are here now and I’m assuming you are ready to take your business to the next level and really dive in so you can see where your money is going and how to grow your profits and sales.

So please don’t let your lack of knowledge stop you from this amazing opportunity to put more money in your pockets!

Hate Math? Don’t Worry, It’s as EASY as Learning Your ABC’s

I know what some of you are thinking, “God I hate math!” I just see those numbers and just see a lot of gobbledygook.

Don’t worry, you don’t need to be a math wiz. You just need to learn how to read numbers and how they flow. I promise it is just some basic stuff.

Think of it this way…

Have You Ever Taught a Child How to Read?

Let’s face it, you didn’t just hand them the book and said have a go at it kid!

No, you started with teaching them their ABCs, and then after that, you taught them how to put the letters together to create words like cat and dog.

After that, you grabbed the Cat in the Hat book off the shelf and you start teaching them how to put the words together to create sentences.

Eventually, they became a much better reader and soon they graduated from a picture book to book with no pictures and before you knew it, they were reading Harry Potter and War and Peace.

OK, maybe not that last one. LOL

Here’s the thing, when you handed the kid that first book, it looked like a bunch of gobbledygook to them. None of it made any sense.

And I’m going to bet that the first time you picked up your profit and loss statement you had a similar experience.

You understand what numbers are, but do you really understand what any of it means?

Just like a child needs to learn to read to be successful in life, you need to learn how to read your profit and loss statement to be successful in business!

Sure, it won’t be easy, but if a kid can do it, I promise you, you will be able to learn how to read your profit and loss statement too!

The Formula You Must Know!

Now, before we jump in, there is one formula I want you to memorize.

Now, before we jump in, there is one formula I want you to memorize.

Don’t worry. Remember, this isn’t about learning all kinds of math. We are just learning how to read numbers.

It is just this particular formula that helps you understand how money flows through your business.

Here is what I want you to memorize:

SALES – COST OF GOODS – EXPENSES = PROFITS

Nice and simple.

This is the formula that you will use not only to read your P&L but you will use it to determine if you should make big purchases in your business like new equipment, programs to buy, and even how to hire a new employee. You can use it to make sure you are pricing correctly as well. But more on that in a bit.

This one calculation can be the difference between you making money or losing your shirt!

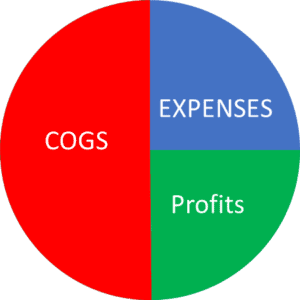

Your Profit & Loss Has 4 Key Buckets

Sales (Revenue), Cost of Goods Sold (COGS), Operational Expenses (Expenses), and Profit (both gross and net).

In our next few sections, we will take a closer look at each of the buckets of your Profit and Loss Income Statement.

GET YOUR P & L Income Statement Cheat Sheet Here

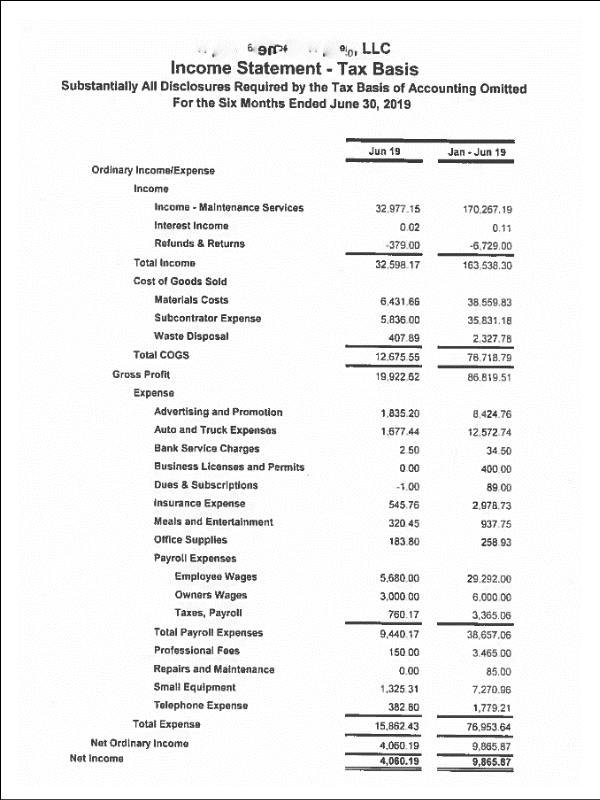

It All Starts with Sales!

Time for us to start diving into what is in your profit and loss statement.

If you go back to our formula of Sales – COGS – Expenses = Profits, then it is safe to say, everything starts with sales.

Think about it, without sales, there is no profit. Without sales, you can’t pay for your goods or expenses.

So, the top of your P&L always starts with Sales. You might see these numbers called Revenue and referred to as your top line.

Sales = Revenue = Top Line

For many of you, I’m going to bet that all of your sales are lumped into one big pot.

Later we will discuss the benefit of breaking your sales into categories. For example, residential sales vs commercial sales, or different categories of products like products vs services you offer.

But for now, just know that the top of your P&L is just capturing all the sales that flow into your business.

You might have a refund line as well if you capture those in your system.

So your NET SALES will be all the sales added up minus any refunds that you give.

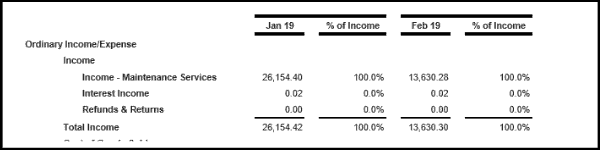

Example of Income

COGS – Cost of Goods Sold – Costs to Deliver Your Products/Services

Your next section (bucket) is all about capturing the money you spend to create your products or services.

For example, if you sell party balloons for $1 each, you still must purchase the balloons to sell them.

Odds are you buy your supply from a balloon wholesaler. So let’s say you pay 50 cents per balloon. This means you have product costs of 50 cents per balloon.

Since most of you are on what is called a cash basis, meaning you account for things as they happen in real-time, then sometimes, your costs might be higher than your sales for the month.

Since most of you are on what is called a cash basis, meaning you account for things as they happen in real-time, then sometimes, your costs might be higher than your sales for the month.

Remember, your P&L is capturing what happens during the month. Let’s take a look at how the P&L would capture your balloon sales.

First, you must purchase a case of balloons. If you spend $50 to buy the case of 100 balloons. Your P&L will show Cost of Goods (COGS) for $50 that month. Regardless of how many balloons you sell.

But let’s say you got your shipment in at the beginning of the month and during the month, you sold 75 of the balloons at $1 so you now have $75 in sales.

Your P&L will show $75 in sales and $50 in COGS.

COGS – Cost of Goods Sold – Service-Based Businesses

Since many of you will have a serviced based business vs a product-based business, let’s take a look at how that looks in your P&L.

Maybe you are a landscaper. You mow lawns and trim bushes. So there really aren’t any products that you sell, you just exchange your time and skills for money. What would your COGS look like? Do you even have any?

YES!

However, many of you are currently capturing them. If you do, it is for a very small amount as you are missing one of your biggest cost of goods.

You are not getting a true number!

In order for you to mow that yard, you need to physically mow it. To trim the bushes, you need to physically do it. Just like someone must physically groom the dog, install the water heater, or teach the music student.

Remember, you are exchanging time & skill for money.

Remember, you are exchanging time & skill for money.

You need to assign money to the hours spent on the “doing” of the service. Whether it is you or someone that works for you. A fair wage should be included because someone has to do it or it doesn’t happen.

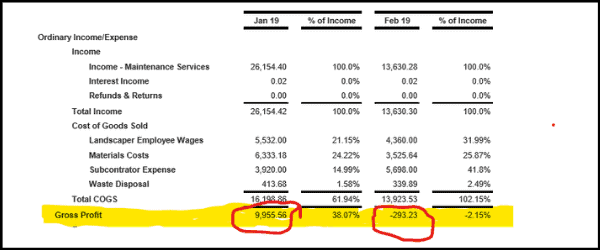

In the example P&L for this landscaper, you will notice the wages are included. This particular landscaper didn’t always have them this way. Once he swapped them to his COGS, his quotes became better and his profits went up!

Wait, Wouldn’t All Payroll Be COGS Then?

Now, I know what some of you are thinking, those balloons don’t sell themselves you know. Why aren’t those employees included in COGS?

Good question. When you sell products, you are basically ringing them up and handing them across the counter. You aren’t actually making the balloon.

The act of check out, stocking, cleaning, answering phones, etc is considered an operational expense.

If you had to make the product or assemble it that is different.

Take the example of a bike. If you purchased assembled bikes and then resold them, it is just a product. However, if you bought the bike parts and then assembled it yourself, you now have the labor needed to create the product. The labor is now a cost to the bike.

The best rule of thumb is, if you must spend time providing or assembling a product or service, then you are looking at that time being captured in the “doing” under COGS.

The “Doers” vs the “Helpers” – Part 1

Think of any payroll wages as two buckets. The “Doers” and the “Helpers”.

Think of any payroll wages as two buckets. The “Doers” and the “Helpers”.

The “Doers” are those that do the actual service you provide. The “Helpers” are those that help run the business. Any payroll with customer service, phones, registers, etc are “helpers”

Any wages paid to “doers” will go in COGS and any wages paid to “helpers” will go under operational expenses. (More on expenses shortly)

Now, any payroll that is captured in COGS will just be the hourly wage you pay. All the costs associated with payroll goes under expenses.

So, if you pay someone $15 hour then just the $15 would go under COGS, all the other payroll expenses you have for that employee are captured under operational expenses.

CAPTURE YOUR TIME!

Now before we leave this topic of payroll and COGS I want to talk about something you are probably not doing but you need to do!

Most small business owners go out and create sales, pay their bills then pocket what is left. The problem with this is, you never get a true idea of your cost of goods.

As a badass business owner, you are wearing two hats. One as the “doer” and one as the business owner. You should be getting “paid” as a doer and then rewarded at the end of the day with the business profits with an owner’s draw.

Remember, at some point, you will replace yourself as a doer. Or at least cut back to spend more time on the business. When that day comes you will want to know what that impact your profit will take. By capturing the “Doer” wages in COGS, you will never have a surprise.

While you might think of your time as worth $50 an hour, when you are a “doer” your value is only what you would pay as a “fair” wage.

If you would pay someone $15 an hour to do that same job, then you capture $15. The reason you do this is so you have a true cost of goods for your P&L.

If you are really worth the $50, then the other $35 should show up in your profits if you are doing it right.

You Need the Right Wages to Price Correctly!

To get a true cost of goods, you need to use this hourly wage you pay yourself or anyone else.

To get a true cost of goods, you need to use this hourly wage you pay yourself or anyone else.

If you know that a job will take 3 hours. Then you can budget $15 x 3 hours for $45 in costs.

Let’s say you charge $100 for the job, we know your sales will be $100 and your COGS will be the costs for any supplies plus the “doer” wagers. If supplies are $5 and wages are $45 you know your COGS are $50

Even if you are a sole proprietor with no employees you need to do this best practice.

You will be shocked how much money you leave on the table by thinking like an employee vs an owner!

Why are COGS So Important?

Now, before we leave COGS I want to re-emphasize why they are so important.

Before you make a dime in your business, you must pay the costs associated with your sales. It is from this difference that we set the stage for the potential profits you might have.

If you have sales of $100 but it costs you $100 to provide those sales, then there is no profit.

As we start to look at more examples, you will soon realize that your COGS line can be a game-changer in adding more profits to your bottom line. Capturing them correctly will save you tons of lost profits as you build your team or add other products or services.

Gross Margin Dollars – Your Potential Profits!

When looking at your P&L we want to check out one of the key lines that show your potential profits.

Gross Profit (Gross Margin Dollars & Percent)

Simply put, it is just the difference between your what you take in (sales) minus the costs to provide that product or service (COGS)

Sales – COGS = Gross Profit

Your gross margin dollars are just the profit you have prior to paying any other expenses.

Think of it this way. You meet with a customer. They want to buy 10 widgets. So they pay you $10 per widget and now you have $100 in sales.

Then you feel a tap on your shoulder, and it is your widget supplier. He now wants to be paid for the widgets he sold you. His wholesale price to you is $4 per widget. So you look at the $100 in your hand and you turn around and give him his $40 ($4 x 10 widgets).

Now you stand there with $60 in your hand (the original $100 minus the $40 you paid him).

Your gross profit is $60. Or $60 in potential profits.

It is called potential profit because now you have the costs to run your business. Which brings us to our next big bucket…Expenses.

Gross Profit Example

Operating Expenses – The Costs of Doing Business

In our example above, you might recall you had $60 in gross profit dollars. From here, we have other bills the business will need to pay. We call these operating expenses.

Now, I know it can be confusing since COGS and Expenses are both a bunch of bills that need to be paid. So it is common for people to just lump them together. This might be what you are doing today.

But now that you are a badass business owner learning your business numbers, you know better!

You understand that there is a difference between bills that create your product or service and those that keep the business afloat.

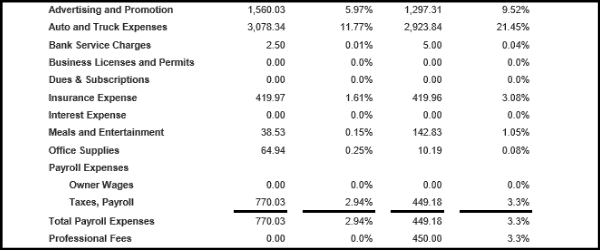

Your operating expenses will be everything else that you are paying. A few examples would be advertising, insurance, vehicle costs, utilities, repairs, maintenance, payroll costs, and a host of other things that can really add up.

The “Doers” vs the “Helpers” – Part 2

Earlier, you recall we discussed two types of payroll. The “doers” and the “helpers”. Your “Doer’s” wages are under COGS and your helpers go under expenses, along with all other costs associated with payroll, like payroll services, taxes, unemployment, insurance, uniforms, training, etc.

Your “Helpers” wages will be under operational expenses. Remember, they support the business to help it run smoothly. They answer phones, ring up folks, follow up, do bids, etc.

Keep in mind, the true cost of an employee will not be the $15 an hour you pay them, it will actually be their wage plus all the payroll costs. This is the reason I teach people to figure out how much an employee needs to produce to pay for themselves.

Operational Expenses Can Suck Up Your Profits!

The expenses you pay can add up. $25 here, $50 there, and $250 over there, and next thing you know, you have $2,000 or more coming out of your gross profits. Ouch. You might as well be flushing money down the toilet!

The expenses you pay can add up. $25 here, $50 there, and $250 over there, and next thing you know, you have $2,000 or more coming out of your gross profits. Ouch. You might as well be flushing money down the toilet!

There are some business owners that have expenses as high as $5,000 or more if they pay rent for brick and mortar space or have outstanding loans with high payments.

Let’s take a look at how expenses play a role in your bottom-line profits.

Remember our calculation: Sales – COGS – Expenses = Profits.

Here is an example. You have a good, solid month of $10,000 in sales. Your cost of goods for the sales ran $4,500 and your expenses were $2,500. Using our calculation, we just plug in the numbers. Sales ($10,000) – COGS ($4,500) – Expenses ($2,500) = Profits ($3,000).

Keep in mind, if you waste money in the expense bucket, it comes right out of your pocket!

Every dollar you save in expenses will go straight to the bottom line. Something as simple as a $50 monthly bill for something you no longer need could be costing you $600 in profit a year.

Later, I’ll show you how it is also causing you to work much harder and longer hours too!

BEST PRACTICE: I’m going to take a moment here to really, really, really encourage you to be a debt-free business! Debt is one of the biggest reasons businesses fail! Don’t be a statistic!

Expenses Example

It is all About the Profits!

I get that you love what you do. You love to take in those sales.

But here is the thing, none of it matters if the business isn’t creating profits!

The bottom line is, the most important line on your profit and loss income statement is the net income/profit line at the end of the report.

Here is where you discover if you are a business or a job you have created for yourself.

While you might get paid out of “wages” it is the profit that separates you from employee and owner.

Example of Profits

GET YOUR P & L Income Statement Cheat Sheet Here

What Do You Do with the Profits of Your Business?

I know what you are thinking, wow, I get to keep all that money?

Not really.

Your profits will typically go into 3 buckets in the early days of your business. You will want to set aside some for taxes (yep, Uncle Sam will want his share), you will set some aside for retained earnings and you will have some for the owners draw.

Taxes can range dramatically depending on your situation. I will not go into detail here. But based on your situation you may need to set aside 25% or more so you have the money to pay your quarterly taxes. See a tax professional for your unique plan.

Retained Earnings are profits that you set aside to reinvest back into the business. They might sit in the account to pay bills during your slower months, they might be used to purchase some equipment or more inventory. You will always have the money you want to set aside.

Your Owners Draw is the money you take out of the business above and beyond paying yourself for doing work in the business. Some folks choose to keep it all in the business for a bit (retained earnings) and some folks pull out what is left after taxes and retained earnings.

PLEASE SET MONEY ASIDE TO PAY YOUR TAXES!!! IT IS A HUGE MISTAKE FOLKS MAKE!!

Why You Might Be Working Way Harder Than You Need Too!

Remember earlier when we had that example of $50 a month of a wasted item that was a $600 waste in profit?

Remember earlier when we had that example of $50 a month of a wasted item that was a $600 waste in profit?

What if I told you that in order for you to pay for that $600 you had to do $2,400 in sales just to break even! Wait, what??!!?

While $600 might not seem like a lot of money, think about how many hours you spend creating the $2,400 in sales?

$2,4000 in sales you will never see a dime of by the way!

Keep in mind, this $600 is after you those create sales and after you pay all the other costs in your business.

Now, you are probably wondering how I just figured this number out?

It is actually pretty simple, and you can do it in less than 2 minutes any time you are curious about what you need to do in sales to pay for anything.

Want to know how?

Through the power of knowing percentages.

Let’s take a look.

Dollars and Percentage – Easy as Pie

Have you ever wanted to purchase something for your business but you weren’t sure if you could afford it?

Have you ever wanted to purchase something for your business but you weren’t sure if you could afford it?

What if you could determine exactly what you need to do in sales to pay for it? Well, there is!

And the cool thing is, once you learn the trick, you can figure out what return you need on any purchase in a matter of minutes.

It is all through using dollars and percentages. Let’s take a look.

Let’s revisit our calculation: Sales – COGS – Expenses = Profits.

Since everything starts with sales, we can think of those sales as a piece of a pie.

Now, you don’t get to keep your entire pie as you need to share it with two others and what is left is yours.

Your pie will be cut into 3 parts – COGS, Expenses, and Profit. Like this

If you give up half your pie to your COGS then you know that COGS were 50%. Then let’s pretend your Expenses take up a quarter of the pie, then expenses are 25% and your profits is what is left – the remaining 25%. (100% – 50% – 25% = 25%)

Now, your P&L will not show you a pie so we need to use our calculation and the numbers we can get from your Profit and Loss.

Let’s go back to our calculation: Sales – COGS – Expenses = Profits.

Using our example earlier we replaced those items with the following: $10,000 – $4,500 – $2,500 = $3,000 in profits

Grab the Calculator – It Really is This Easy!

Now let’s convert these dollars into percentages and see how this helps you know what you need to pay for new equipment or hiring a new person.

Now let’s convert these dollars into percentages and see how this helps you know what you need to pay for new equipment or hiring a new person.

Once again, sales are always 100%. To figure out the other percentages we just use the numbers we have and figure out what percentage of the pie (sales) we give to the COGS bucket and the Expenses bucket.

If our COGS are $4,500 we just divide that by the total sales.

It would look like this $4,500 (COGS) divided by $10,000 (Sales) and we get .45. To get a percentage we just slide that decimal 2 spots to the right, which is 45%.

Let's do all 3 buckets.

You would get this:

- COGS – $4,500 / $10,000 = .45 or 45%

- Expenses – $2,500 / $10,000 = .25 or 25%

- Profits – $3,000 / $10,000 = .30 or 30%

Or 100% (sales) – 45%(COGS) – 25% (expenses) = 30% (profits)

See how easy? Your head only hurts a little.

Cool Things Your P&L Can Do

Here is why understanding your P&L can really help you make decisions in your business.

Here is why understanding your P&L can really help you make decisions in your business.

Let’s say that you want to purchase a piece of equipment for $500. The next question is, how much do you need to do in sales to break even on it?

Since you will be paying for it out of the profits of your business, and we know from your P&L what percentage your profits, run, we can figure out the sales needed pretty quickly.

Let’s say you know that your profits tend to run 30% of your sales. We now just take the amount you need – the $500 – and divide it by this 30% to get the sales we need.

Here is what it would look like:

$500 divided by .30 (30%) = $1,666 in sales

If we check our math, we just do the reverse of what we just did. (You might remember this from school)

If we know profits are 30% of our sales, we just take the $1,666 and multiply it by 30% and we get the $500.

Easy, Peasy, Lemon Squeezy.

Can you see how handy this can be when determining what you need to do to break even?

NOW – DON’T RUN AWAY!!

I know things just got crazy and hard and math makes your head hurt, but don’t worry. I’m going to stop with the calculations for now. LOL

But, if you do want to learn more, just know that I have several other resources to help you with this.

You can check out the YouTube Channel Playlist for Knowing Your Numbers.

Here is a P&L Basics Video to get you started

There is also The Understanding Your Business Numbers Course where we visually walk you through these so you can see them in action.

Remember, you are at the beginning stages of learning to read and interpret your P&L. You aren’t going to walk away from this one article and become an expert.

However, you will know more than when you started and you will soon graduate from the Cat and the Hat version of your P&L and soon you will be reading your favorite new book!

Your Profit & Loss Statement is Full of Fun & Amazing Stuff!

Here’s the thing, there are so many hidden nuggets in your P&L.

Here’s the thing, there are so many hidden nuggets in your P&L.

It starts by you diving into and understanding these 4 buckets (sales, COGS, expenses & profits), and soon you will start to see how money flows through your business.

The good, the bad, and the ugly of it all.

As you get a better understanding, you will be able to look for trends from month to month, year over year, and you will see tons of opportunities to grow your sales and your profits.

Want to know what parts of your business make you the most money?

Your P&L can tell you.

Want to know what parts of your business are costing you tons of money that should be going in your pocket?

Your P&L can tell you that as well.

Want to know how much you need to do in sales just to keep the business afloat?

Yep, your P&L will tell you.

Want to see why you seem to make more money some months and a lot less in other months?

You guessed it, your Profit & Loss Income Statement will tell you that as well!

More Sales DO NOT Equal More Profits!!

I’ll say it again.

The mistake most business owners make is they think that chasing more sales will make them more money.

I’m going to bet that you have worked your tail off some months and at the end of the day, your profits were nothing like you thought they would be.

This is exactly what I’m talking about.

The bottom line is you chased the wrong sales.

The cool thing is, understanding your P&L can help!

Stop working so hard for little money!

Minutes to Learn – Years to Master

I could go on and on about the power of understanding your Profit & Loss Income Statement. But I would only add to the confusion.

So for today, I”ll just remind you of the core concepts we have covered…

Your P&L is made up of 4 Buckets: Sales, Cost of Goods Sold (COGS), Expenses, and Profit.

The money flows through your P&L like this: Sales – COGS – Expenses = Profits.

If you start with these two concepts you will be light years ahead of most other business owners.

Tools to Help You Grow Your Business Number Knowledge

Since I know you will want to continue to your education on business numbers, I have a few other tools out there and I’m going to continue to create even more.

To help you out, I’ve put this entire article into an eGuide you can download so you can use it as a reference as you learn more about your Profit & Loss Income Statement. –

If you just want the short cheat sheet, here is where you get that: P&L Cheat Sheet

Over on the YouTube Channel, there is a series dedicated to Knowing Your Business Numbers with new videos being added. – CHECK OUT THE CHANNEL

Here is that P&L Basics Video to get you started

If you really want to go crazy, I have a course that you can take at your own pace.

People ask me all the time why I don’t charge more and honestly; I want there to be no reason for you not to dive in deeper into understanding your business numbers.

The P&L section alone will help you make hundreds if not thousands of more profits in the first 6 months once you start diving in and tweaking a few things.

CHECK OUT THE UNDERSTANDING YOU BUSINESS NUMBERS COURSE

NO MORE EXCUSES!

I am so proud of you!! You really are a badass business owner if you made it this far!

I know you haven’t had time to dive into your P&L yet.

I know you are overwhelmed when you look at this report.

I know you are scared about what you will find.

It’s ok. It doesn’t matter what you were doing yesterday. What matters is the action you start taking today!

I just need you to stop making excuses for not even trying to learn.

I don’t blame you for where you are today.

But tomorrow is a different story.

You are here because you want to change the course of your business and make more money.

Your Profit & Loss Income Statement holds the key to unlocking those profits!

If you ever have a question, feel free to reach out.

Tammy

Before You Go.

Don’t Forget to Listen to the

Don’t Forget to Listen to the

Badass Business Owner Podcast for even more great tips to help you take your business to the next level!

Get Weekly Business Tips

Each Week I'll Share One Quick Business Tip to Help You Start Increasing Your Profits! Start Earning $3,000, $5,000, $10,000 a Month.

Stop working those crazy hours and start working smarter, not harder.

Time to Increase Your Profits, Boost Your Sales, Improve Your Processes and Develop Stronger Teams!

TIME TO START EARNING $100,000 a Year in TAKE HOME PAY!!

What is a Profit & Loss Income Statement?

What is a Profit & Loss Income Statement?